Growing Embrace of Appeals Saved Wise County Property Owners $48 Million in Value

O'Connor discusses the growing embrace of appeals in Wise County and how it saved property owners $48 million in value.

DECATUR, TX, UNITED STATES, November 5, 2025 /EINPresswire.com/ --Like any other area in the orbit of the Dallas-Fort Worth metroplex, Wise County has both an independent lifestyle and one that is influenced by its neighbors. Closer to Fort Worth than Dallas, Wise County has a more rural aesthetic compared to swanky suburbs like Denton or Collin counties. Known for bountiful natural resources and expansive land, Wise County is a keystone area in the DFW sprawl. While not stereotypically suburban or exurban, Wise County is seeing a growing influx of commuters looking to escape crowding in the urban jungle. This has led to rising property taxes and values for both homes and businesses.

Property taxes are usually the largest single expense a Texas taxpayer will see. While Texans have long relied on exemptions to keep property values in check, property tax appeals are becoming another popular option. Once only a technique for the rich, these protests are now being used for every property type. Now that both informal and formal appeals have been finished, we can examine just how effective they were in 2025 in reversing rising taxes.

Combined Appeals Help to Rebound from Rising highs

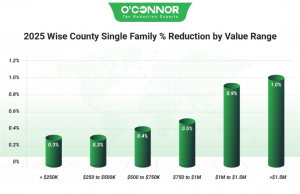

In 2025, the Wise County Appraisal District (Wise CAD) increased residential property values dramatically, raising the total assessed value by 6.5% to $6.97 billion. Homes of all prices and sizes experienced this upswing. Combined appeals were able to drive values back in places, eventually reaching a reduction of 0.4%, bringing the total down to $6.94 billion. Falling 0.3%, homes worth between $250,000 and $500,000 were in the No. 1 spot with $3.33 billion. Homes assessed from $500,000 to $750,000 were reduced by 0.4% to $1.79 billion. Modest homes worth under $250,000 were able to earn a cut of 0.3%, falling to $849.94 million. Generally, the more expensive the home, the greater the reduction. O’Connor was able to get homeowners stronger returns, netting an overall reduction of 1.3%.

While stacked with residential value, there are very few mansions in Wise County, with most homes being of modest sizes. Residences between 2,000 and 3,999 square feet were the most valuable, with a total of $3.60 billion following a cut of 0.4%. Homes under $250,000 experienced a reduction of 0.3%, falling to $2.92 billion. The largest reductions were 0.7% and 1.3%. These were for homes measuring 4,000 to 5,999 square feet, and those assessed at 6,000 to 7,000 square feet respectively. True luxury homes received no reductions of note.

A good indication of how much Wise County is growing is to look at the major recency bias in home construction. The most valuable timeframe for construction is the boom period from 2001 to 2020, which produced $2.82 billion in value after a reduction of 0.2%. Homes from 1981 to 2000 got a cut of 0.2%, totaling $1.48 billion. New construction jumped up by 28.3%, totaling $1.34 billion. This was eventually lowered by 0.9% to $1.33 billion. All other homes combined account for only 18% of the total value.

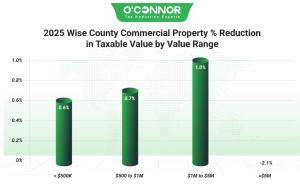

Commercial Properties Shed $25.55 Million in Taxable Value

Wise CAD hit business owners with similar value increases to homeowners, assessing an increase of 6.5%, which meant a final tally of $5 billion. Organized resistance through appeals managed a reduction of 0.4%, bringing the total down to $4.98 billion. Wise County was unusual, in that businesses worth over $5 million were the least valuable when combined. Usually, these properties can hog up to 50% of a county’s value. However, those in Wise only reached $669.94 million with no reduction. Businesses worth between $1 million and $5 million saw a reduction of 1%, achieving a total of $1.77 billion. Commercial real estate assessed at $500,000 to $1 million totaled $1.19 billion, while those under $500,000 reached $1.36 billion. These were cut by 0.7% and .06% respectively. We at O’Connor partnered with our clients to earn an overall reduction of 12.4%, including 24.9% for businesses worth between $500,000 and $1 million.

Like many counties that are rural in origin, Wise’s top commercial property is raw land at $4.10 billion. This did not receive any type of reduction, which hampers lowering the overall total. Warehouses were the No. 1 developed property type, dropping 1.9% to $269.95 million. Offices were right behind with $256.29 million, following a cut of 2.4%. Retail landed a strong reduction of 5.4%, securing a final tally of $133.97 million. Dropping 4.7%, apartments achieved a total of $155.52 million.

Commercial property did not lean as heavily on recent construction as homes, though the huge value of raw land can certainly throw off averages. Like homes, the period from 2001 to 2020 provided the most value outside of raw land, reaching $452.87 million after being lowered by 3.6% by appeals. Business real estate from 1981 to 2000 was next with a reduction of 2.4% and a total of $253.21 million. New construction reached $85.01 million after being cut down by 1.7%. This had previously climbed 56.5%. The two oldest property types saw some of the best reductions in the county.

Apartment Owners That Used O’Connor Quadrupled Their Savings

Apartments are usually the most valuable of commercial properties in most major counties, but due to Wise’s rural nature, they are a relatively small aspect of the whole. Totaling $163.13 after an initial increase of 27.9%, apartments saw the largest value spike in the county. This was later protested down by 4.7%, reaching a new total of $155.52. The recency bias observed for homes was just as strong for this multifamily housing, with $74.40 million in value coming from the period of 2001 to 2020. New construction reached a final total of $33.53 million. These figures were the result of cuts of 5.4% and 6% respectively. Those built from 1981 to 2000 contributed $33.50 following a reduction of 5.4%. We at O’Connor were able to bring in a massive decrease of 19.4% for our clients, over four times the county number.

Offices Slice off $6 Million Thanks to Protests

Offices lagged behind only raw land and warehouses when it came to value. Originally spiking by 15.7% to $262.47 million, offices were eventually protested down 2.4% to $256.29 million. 80% of all office value was constructed between 1981 and 2025. The largest category was once again the boom era of 2001 to 2020, which contributed $111.15 million after dropping 3.6%. Those from 1981 to 2000 were responsible for $82.54 million, which was the result of a reduction of 1.1%. New construction added $13.36 million, which came after a drop of 1%. When office owners joined O’Connor for their protest, they saw an improvement in their results, with a total reduction of 6.2%.

Warehouse Taxable Value Decreased by 1.9%

Warehouses are the No. 1 commercial property outside of raw land. Wise CAD initially handed out an increase of 12.6%, but this was countered with a battery of appeals that produced a reduction of 1.9%, which resulted in a final tally of $269.54 million. 85% of all value was constructed between 1981 and 2025, showing just how much the county has grown in the last few decades. $134.33 million came from 2001 to 2020 alone, which was thanks to a decrease of 2.2%. Those from 1981 to 2000 saw a reduction of 0.6% to $67.06 million. New construction managed to get a reduction of 4.4%, dropping to $26.81 million. Warehouses constructed from 1961 to 1980 still held value, reaching $36.70 million after being cut by 1.6%. O’Connor once again delivered for our clients, managing an overall decrease of 12.5%.

Wise CAD divided warehouses into a few different categories to aid in evaluation. Generic warehouses were the largest category with $185.44 million, receiving a reduction of 0.6%. Mini warehouses were in the No. 2 position with $61.80 million, while office warehouses managed to land $61.80 million. These saw reductions of 0.1% and 6% respectively.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.